Solid returns from the Baltic real estate market

Special Mutual Fund Titanium Baltic Real Estate (AIF) invests in properties located in Estonia, Latvia and Lithuania. A broad selection of different types of properties is selected for the fund, and it offers investors a diversified portfolio in an interesting market area.

The investments may include residential, commercial, office, logistics, hotel, industrial and public properties, among others. The properties are mainly new, rather new, recently modernised, under construction or renovation for long-term ownership.

The aim is to achieve an annual return of approximately 7%*, mainly based on cash flows, a large proportion of which is distributed to investors as annual profit shares.

The fund is aimed at both private and institutional investors and its recommended holding period is a minimum of 5 years. The fund is open for subscriptions once a month and redemptions twice a year.

It is also possible to invest in the fund through investment-linked insurance or a capitalisation contract.

*) Investment always involves financial risk. The value of an investment in the fund may rise or fall and the performance target may not be achieved. Entry or exit charges have not been taken into account in the calculation of the performance target. The risks are described in more detail in the Key Information Document (KID) and the Fund Prospectus.

Characteristics of the fund

Why the Baltics?

The positive development of the Baltic economy has made its capitals and growth centres particularly attractive to real estate investors. As eurozone and EU countries, the Baltic countries offer a functional and stable operating environment for a Finnish real estate fund.

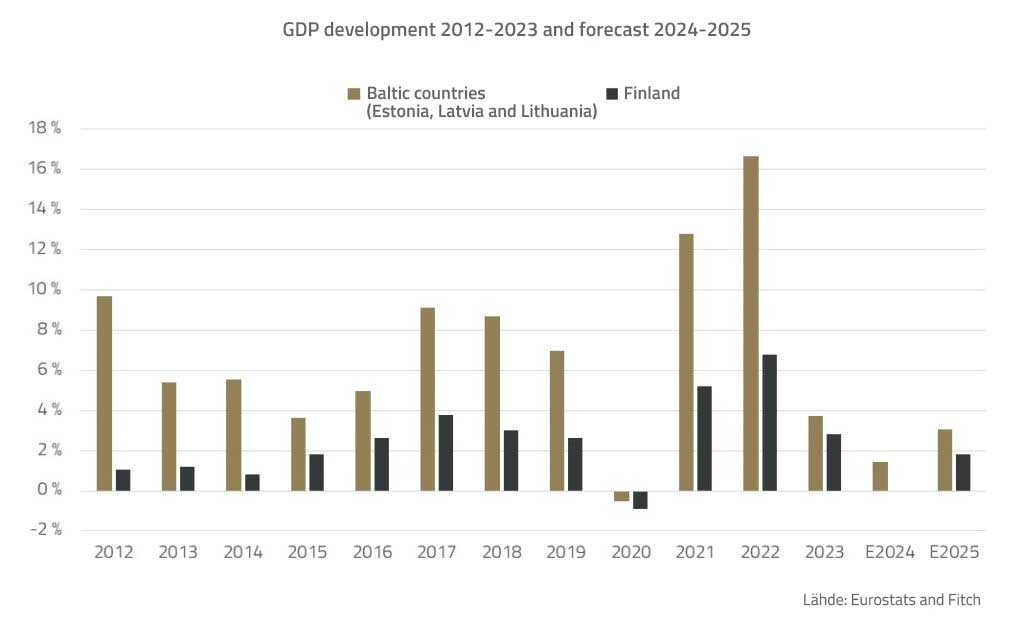

The return targets of properties in Tallinn, Riga and Vilnius are approximately 2% to 3% higher than in Helsinki, and the GDP growth of all the Baltic countries has been clearly higher than in Finland over the past ten years.

- The positive development of the Baltic economy has made its capitals and growth centres particularly attractive to real estate investors.

- The actual and projected GDP growth in the Baltic countries is stronger than in Finland.*

- The yield requirements for properties in Tallinn, Riga and Vilnius are 2% to 3% higher than in Helsinki.*

- As EU member states in the eurozone, the Baltic countries offer a functional and stable operating environment for a Finnish real estate fund.

- Titanium’s experienced portfolio management team has local knowledge and a strong cooperation network in the Baltic countries.

- The fund aims to provide a return in line with the Baltic real estate market.

* Historical performance is no guarantee of future performance.

GDP growth in the Baltic countries stronger than in Finland

Carefully selected investments are diversified into properties, aiming to provide a good return for the fund through both rental cash flows and an increase in the value of the properties. Titanium’s experienced portfolio management team has local knowledge and a strong cooperation network in the Baltic countries.

Benefits of the fund for investors

- Good return potential

- Internationalising real estate market

- Diversified portfolio

- Benefits of a large investor

- Experienced portfolio management team

- An effortless way to invest

- Liquidity of the fund

For businesses

Heading to the Baltics?

Special Mutual Fund Titanium Baltic Real Estate (AIF) offers solutions for businesses that need business premises or property in the Baltic countries.

Your reliable and experienced partner in the Baltics

Titanium develops, manages and maintains the property of your choice in the Baltic countries so that you can focus on what matters the most: your core business. Whether your company already operates in the Baltic countries or is heading to the Baltic countries, our experienced team will help you find the best possible facilities and solutions for your operations.

We offer the keys to growth, taking into account your situation and needs by developing, buying or concluding a sale & leaseback agreement.

The fund’s investments

Titanium Baltic Real Estate invests in properties located in Estonia, Latvia and Lithuania. The fund invests in a wide range of properties, such as residential, commercial, office, logistics, hotel, industrial and public properties. The properties are mainly new, rather new, recently modernised, under construction or undergoing renovation.

Would you be interested? We would be delighted to discuss our services and explore the opportunities we can offer your company. Please submit a contact request, and one of our experts will reach out to you.

Risks

As with any investment, there are uncertainties and risks to consider when investing in Titanium real estate funds. The recommended investment period in Titanium’s real estate funds is at least five years. The fund invests in properties located in Estonia, Latvia, and Lithuania, so the value of the fund may rise or fall as a result of changes in the value of the real estate market. Among others, real estate funds are associated with asset risk, which refers to a situation in which the deterioration of the properties’ characteristics leads to a decline in the value of the asset. Market risks in real estate investments, on the other hand, are derived from the value development of properties, investors’ return expectations and the position of properties in relation to other investments. Real estate funds also involve a liquidity risk, i.e. the risk that the realisation of investments may lead to losses and delay the payment of redemptions, especially in a weak market situation. At times, the sale of real estate or real estate securities may require a long realisation period. The risks and their management methods are described in more detail in the funds’ prospectuses, and we recommend reviewing them carefully.

Performance of the fund

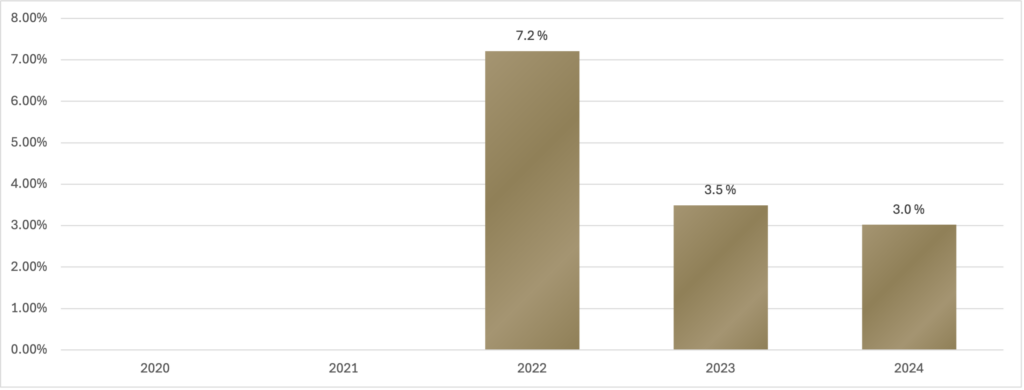

Fund unit performance

Historical performance is no guarantee of future performance. The value of the fund may fluctuate and the invested capital may also be reduced.

Past performance

This chart shows the fund’s performance as the percentage loss or gain per year over the last 5 years. Performance is shown after deduction of ongoing charges. Any entry and exit charges are excluded from the calculation.

Launch date of the fund: 30 June 2021.

Past performance is not a reliable indicator of future performance. Markets could develop very differently in the future. It can help you to assess how the fund has been managed in the past.

Past performance 2024 (pdf) Past performance 2023 (pdf)