Now is the time to invest in Finnish care properties

Special Mutual Fund Titanium Care Real Estate (AIF) invests in Finnish care properties. The properties acquired by the fund provide statutory care services by municipalities and private service operators. Through the fund, investors are strongly involved in securing the framework and availability of high-quality care services, also during the challenging economic situation of the public sector.

The fund offers investors an easy way to benefit from the potential of an attractive property class and aims for annual return of approximately 6–7%, mainly based on rental cash flows. Long-term leases, solvent tenants and comprehensive property insurance policies make the fund’s return target stable and predictable. The return received by the investor consists of the profit share paid annually and the change in the value of the fund unit.

Titanium Fund Management Company Ltd has temporarily suspended the execution of redemptions for Special Mutual Fund Titanium Care Real Estate (AIF) in accordance with Section 12 of the Fund’s rules. For more information: titanium.fi/2025/01/07/ilmoitus-osuudenomistajille-7-1-2025/

Characteristics of the fund

Return based on cash flow

Special Mutual Fund Titanium Care Real Estate (AIF) is ideal for investors who want to diversify their investment assets in real estate. The fund is also suitable as an investment for real estate investors who want more return potential alongside residential investments. Special Mutual Fund Titanium Care Real Estate (AIF) offers investors several valuable benefits:

- Consistent return target, mainly based on rental cash flow

- Aiming for moderate fluctuations in value

- Low correlation with other investments

- Diversified real estate portfolio

- ‘Public and open mutual fund

- Effortless real estate investment

A solution for growing service needs

The investments of Special Mutual Fund Titanium Care Real Estate (AIF) include nursing homes for the elderly, care homes for special groups, health centres, day care centres and properties related to social and youth services. The properties acquired by the fund are new, relatively new or modernised, and each property is subject to a condition survey and valuation by an Authorised Property Valuer (AKA) at the time of acquisition. Geographical diversification is taken into account in the selection of investments.

Leases for care properties are usually long-term, typically a minimum of ten years. The rents of the properties are pegged to the cost-of-living index to protect against inflation. Due to the changing age structure, municipalities and wellbeing services counties have a growing need and legislative pressure to increase the number of different care facilities, ensuring a sustained demand for quality care properties for decades.

Risks

As with any investment, there are uncertainties and risks to consider when investing in Titanium real estate funds. The recommended investment period in Titanium’s real estate funds is at least five years. Among others, real estate funds are associated with asset risk, which refers to a situation in which the deterioration of the properties’ characteristics leads to a decline in the value of the asset. Market risks in real estate investments, on the other hand, are derived from the value development of properties, investors’ return expectations and the position of properties in relation to other investments. Real estate funds also involve a liquidity risk, i.e. the risk that the realisation of investments may lead to losses and delay the payment of redemptions, especially in a weak market situation. At times, the sale of real estate or real estate securities may require a long realisation period. The risks and their management methods are described in more detail in the funds’ prospectuses, and we recommend reviewing them carefully.

Performance of the fund

Fund unit performance

Past performance

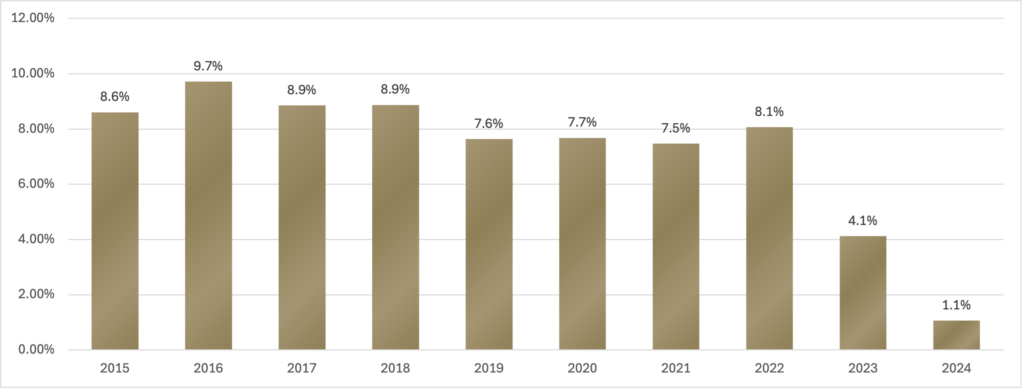

This chart shows the fund’s performance as the percentage loss or gain per year over the last 10 years. Performance is shown after deduction of ongoing charges. Any entry and exit charges are excluded from the calculation.

Launch date of the fund: 15 May 2013.

Past performance is not a reliable indicator of future performance. Markets could develop very differently in the future. It can help you to assess how the fund has been managed in the past.

Past performance 2024 (pdf) Past performance 2023 (pdf)Asset information

Special Mutual Fund Titanium Care Real Estate (AIF) invests in Finnish care properties.

The attached map shows the assets and their details.

Click on a map point to see the details of the asset.