An efortless way to invest in a diversified housing portfolio

Special Mutual Fund Titanium Housing (AIF) invests in rental apartments and residential properties in Finland. The investments include apartment buildings, small apartment buildings and service housing in various forms. The apartments and entire residential properties acquired are mainly new, rather new or modernised. The geographical location and diversification of investments play a key role. Tenant management is carried out by experienced professionals.

The fund offers investors an easy way to invest in a diversified housing portfolio while benefitting from the stable rental cash flow and high occupancy rate of service housing. The fund aims to achieve a return of approximately 5% to 6% annually, mainly based on rental cash flows. The return received by the investor consists of the profit share paid annually and the change in the value of the fund unit.

Titanium Fund Management Company Ltd has temporarily suspended the execution of redemptions for Special Mutual Fund Titanium Housing (AIF) in accordance with Section 12 of the Fund’s rules. For more information: https://www.titanium.fi/2025/01/14/ilmoitus-erikoissijoitusrahasto-titanium-asunnon-osuudenomistajille-14-1-2025/

Characteristics of the fund

Return based on cash flow

Special Mutual Fund Titanium Housing (AIF) is ideal for investors who want to diversify their investment assets into real estate. The fund is also suitable for real estate investors who want more diversification alongside investment apartments or other real estate investments. Special Mutual Fund Titanium Housing (AIF) offers investors several valuable benefits:

- Consistent return target, mainly based on rental cash flow

- Aiming for moderate fluctuations in value

- Low correlation with other investments

- Diversified housing portfolio

- ‘Public and open mutual fund

- Effortless housing and real estate investment

- Opportunity for increase in housing prices

High-quality and carefully diversified housing portfolio

Special Mutual Fund Titanium Housing (AIF) invests in domestic rental apartments, residential properties and service apartments. In addition, the fund acquires service housing in hybrid properties operated by municipalities or private care operators. The apartments and residential properties to be acquired are new, rather new or modernised. The most important criterion for buying rental apartments is their central location in large cities or growth centres.

Tenant management of the fund’s apartments is outsourced to experienced professionals. Each property acquired is subject to a condition survey and independent valuation by an Authorised Property Valuers (AKA) at the time of acquisition. Urbanisation, the shortage of affordable rental apartments and the constantly growing need for service housing are significant factors that favour investing in a decentralised and professionally managed housing fund.

Risks

As with any investment, there are uncertainties and risks to consider when investing in Titanium real estate funds. The recommended investment period in Titanium’s real estate funds is at least five years. Among others, real estate funds are associated with asset risk, which refers to a situation in which the deterioration of the properties’ characteristics leads to a decline in the value of the asset. Market risks in real estate investments, on the other hand, are derived from the value development of properties, investors’ return expectations and the position of properties in relation to other investments. Real estate funds also involve a liquidity risk, i.e. the risk that the realisation of investments may lead to losses and delay the payment of redemptions, especially in a weak market situation. At times, the sale of real estate or real estate securities may require a long realisation period. The risks and their management methods are described in more detail in the funds’ prospectuses, and we recommend reviewing them carefully.

Performance of the fund

Fund unit performance

Historical performance is no guarantee of future performance. The value of the fund may fluctuate and the invested capital may also be reduced.

Past performance

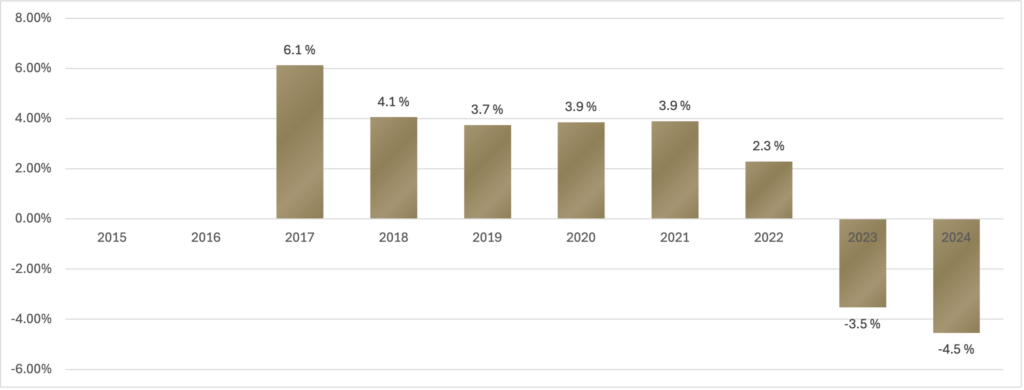

This chart shows the fund’s performance as the percentage loss or gain per year over the last 10 years. Performance is shown after deduction of ongoing charges. Any entry and exit charges are excluded from the calculation.

Launch date of the fund: 30 June 2016.

Past performance is not a reliable indicator of future performance. Markets could develop very differently in the future. It can help you to assess how the fund has been managed in the past.

Asset information

Special Mutual Fund Titanium Housing (AIF) invests in rental apartments and residential properties in Finland.

The attached map shows the assets and their details.

Click on a map point to see the details of the asset.