Carefully selected investments in strongly growing markets

Mutual Fund Titanium Emerging Equity Markets (UCITS) invests its assets in responsibly operating companies in emerging markets with a growing earnings and dividend trend, a healthy balance sheet and a sufficiently high return on equity. The selection of investments is based on quality criteria, which enable investments to be made in above-average quality and better managed companies. The target companies are virtually debt-free, so any rise in interest rates will not have a significant impact on their business operations.

The fund qualifies as an Article 8 fund under the Sustainable Finance Disclosure Regulation ((EU) 2019/2088) promoting environmental and social characteristics, among others.

The fund promotes sustainability factors as part of its investment activities by integrating them into investment analysis, favouring sustainable companies and excluding certain sectors. The fund excludes companies whose main business is tobacco products, gambling, adult entertainment or the arms industry. In addition, the fund pays attention to ensuring that companies do not use child labour and that they do not abuse human rights. These issues are monitored through the UN Global Compact principles, using analysis and data from external research institutes where possible.

The fund’s investment strategy is based on equity selection and therefore takes into account the ESG risks relevant to each company. The analysis is carried out by the fund’s portfolio managers with the support of Sustainalytics and MSCI’s ESG database and research. The fund favours companies with a higher ESG rating in its investments, i.e. the fund uses “positive selection”.

The “do no significant harm” principle applies only to those investments underlying the financial product that take into account the EU criteria for environmentally sustainable economic activities.

The investments underlying the remaining portion of this financial product do not take into account the EU criteria for environmentally sustainable economic activities.

The fund’s ESG indicators are reported in accordance with applicable legislation. Sustainability reporting consists of the fund’s ESG report and the Sustainable Investing Report.

No benchmark index has been designated for the fund.

Strategy

Investing sustainably in emerging markets

Mutual Fund Titanium Emerging Equity Markets (UCITS) is suitable for investors who want to diversify their investment portfolio to the international emerging equity markets without compromising on sustainability.

The objective of the fund’s investment activities is to achieve the highest possible return on the fund unit in the long term through an active investment policy, with a particular emphasis on profitability, dividend payment and sustainability.

Benefits of the investment philosophy

- Knowing that investments are made in profitable and sustainable companies

- Portfolio management is active > large deviation from indexes

- When investing in nearly net-debt-free companies, any increase in interest rates will not have a significant impact on the business operations of the target companies

Markets with strong growth

In emerging markets, economic growth and urbanisation are combined with strong increase in population. Over the next ten years, the growth of the middle class in emerging markets will be significantly stronger than in Europe or the US, for example. The difference in returns in favour of sustainable companies has historically been more pronounced in emerging markets. The shares of responsible companies have exhibited lower volatility and less fluctuation in earnings growth per share compared to non-responsible companies. Additionally, emerging market equities benefit from more attractive valuations and stronger return potential compared to Western markets.

Risks

As with any investment, investing in Titanium’s funds involves uncertainties and risks that should be taken into account. The recommended investment period for Titanium’s funds is at least five years. The fund allocates its assets to equity markets, meaning its value may rise or fall due to fluctuations in stock market prices. Since the fund also invests in markets outside the eurozone, it is exposed to currency risk stemming from adverse changes in exchange rates. Additionally, emerging markets typically carry a higher political risk compared to developed markets. The risks and their mitigation measures are described in more detail in the fund prospectuses, and we recommend reviewing them carefully.

Performance of the fund

Fund unit performance

Historical performance is no guarantee of future performance. The value of the fund may fluctuate and the invested capital may also be reduced.

Past performance

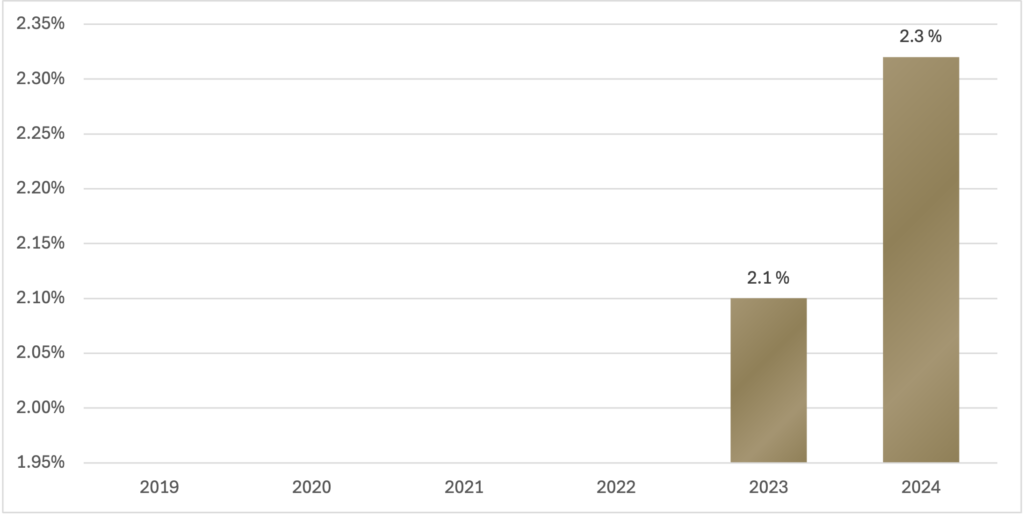

This chart shows the fund’s performance as the percentage loss or gain per year over the last 5 years. Performance is shown after deduction of ongoing charges. Any entry and exit charges are excluded from the calculation.

Launch date of the fund: 1 September 2022.

Past performance is not a reliable indicator of future performance. Markets could develop very differently in the future. It can help you to assess how the fund has been managed in the past.

Past performance 2024 (pdf) Past performance 2023 (pdf)